WIDEIKIS, BENEDICT & BERNTSSON, LLC

THE BIG W LAW FIRM

ATTORNEYS AT LAW

WIDEIKIS, BENEDICT & BERNTSSON, LLC

THE BIG W LAW FIRM

ATTORNEYS AT LAW

Englewood

Boca Grande

North Port

Port Charlotte

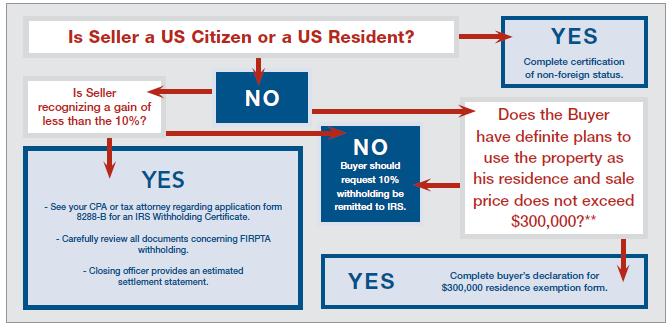

FIRPTA - Foreign Investment in Real Property Tax Act

If applicable, see forms:

W-7 (application for IRS Individual Taxpayer Identification Number)

8288-B (Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests)

Go to www.irs.gov and click on Forms and Publications to get copies of these and other forms.